From the Boardroom to the Workbench

Showcasing Sean Doherty’s journey of innovation, creativity, and leadership—discover projects that spark inspiration and define success.

Sean Doherty’s Universe of Creativity and Craft

Explore Sean Doherty’s journey—a Silicon Valley executive, inventive robot builder, skilled machinist, and dedicated father. Dive into the passions and projects that bring his vision to life.

Exploring Tech, Art, and Parenthood

Discover Sean Doherty’s standout projects, blending innovation, artistry, and hands-on expertise.

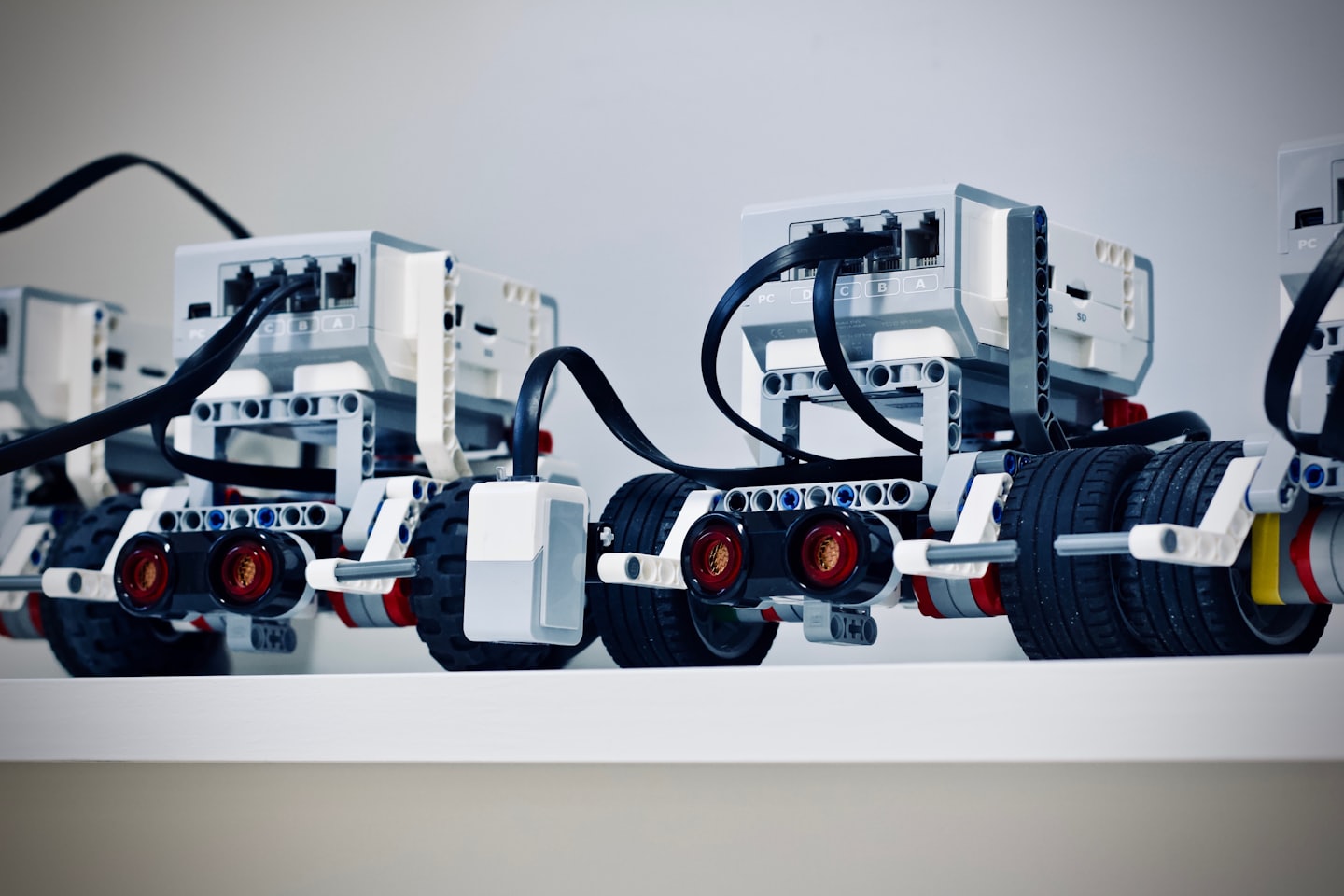

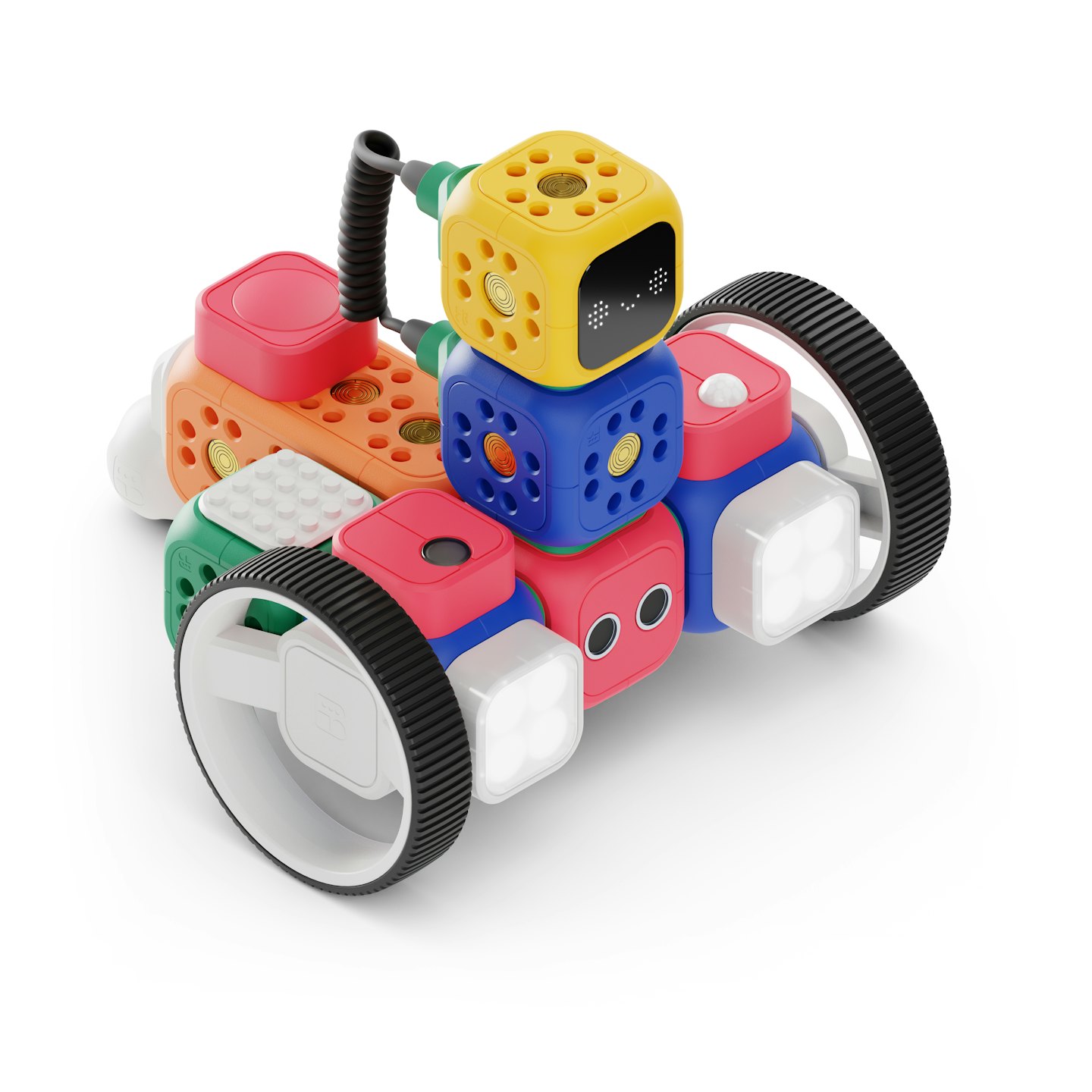

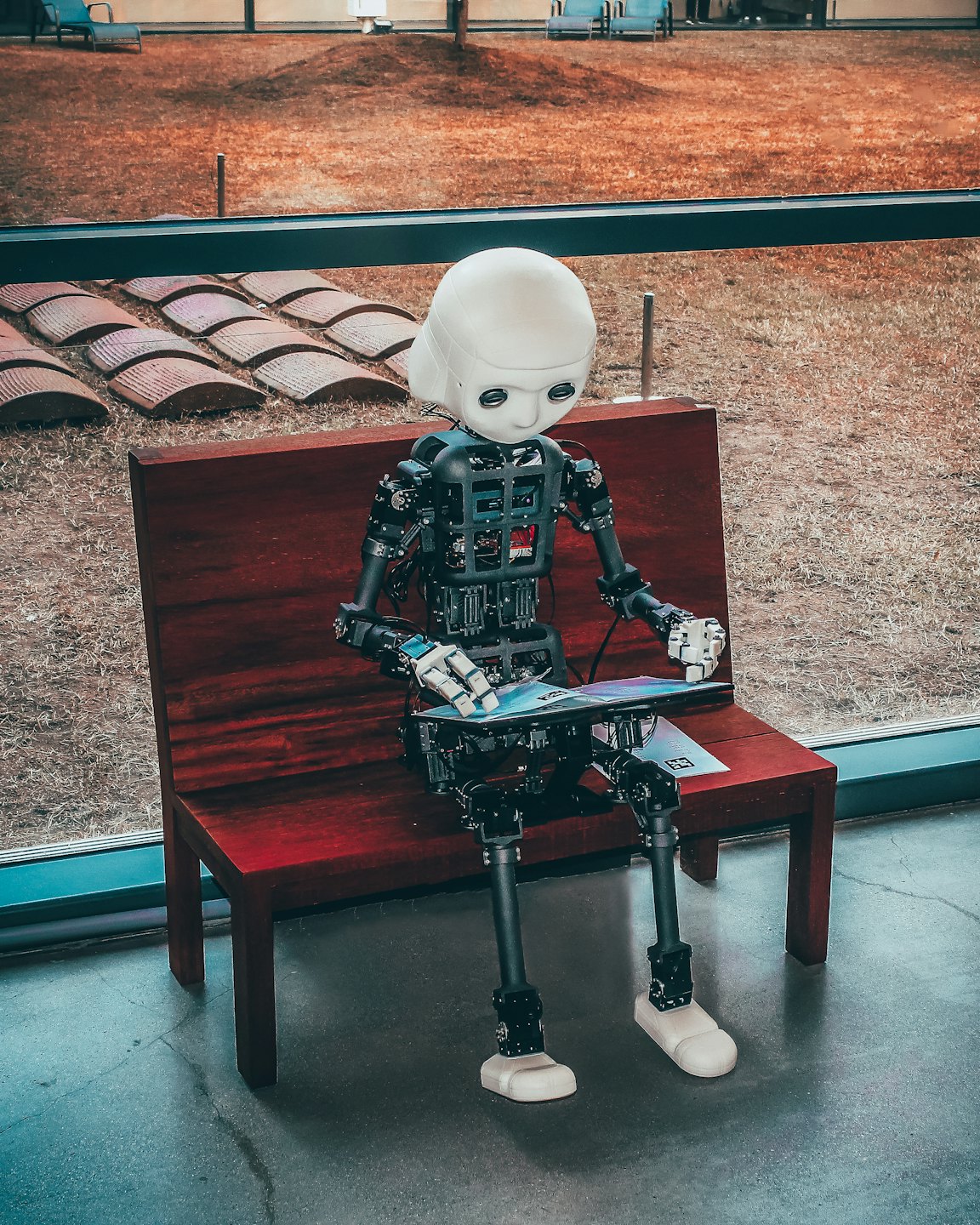

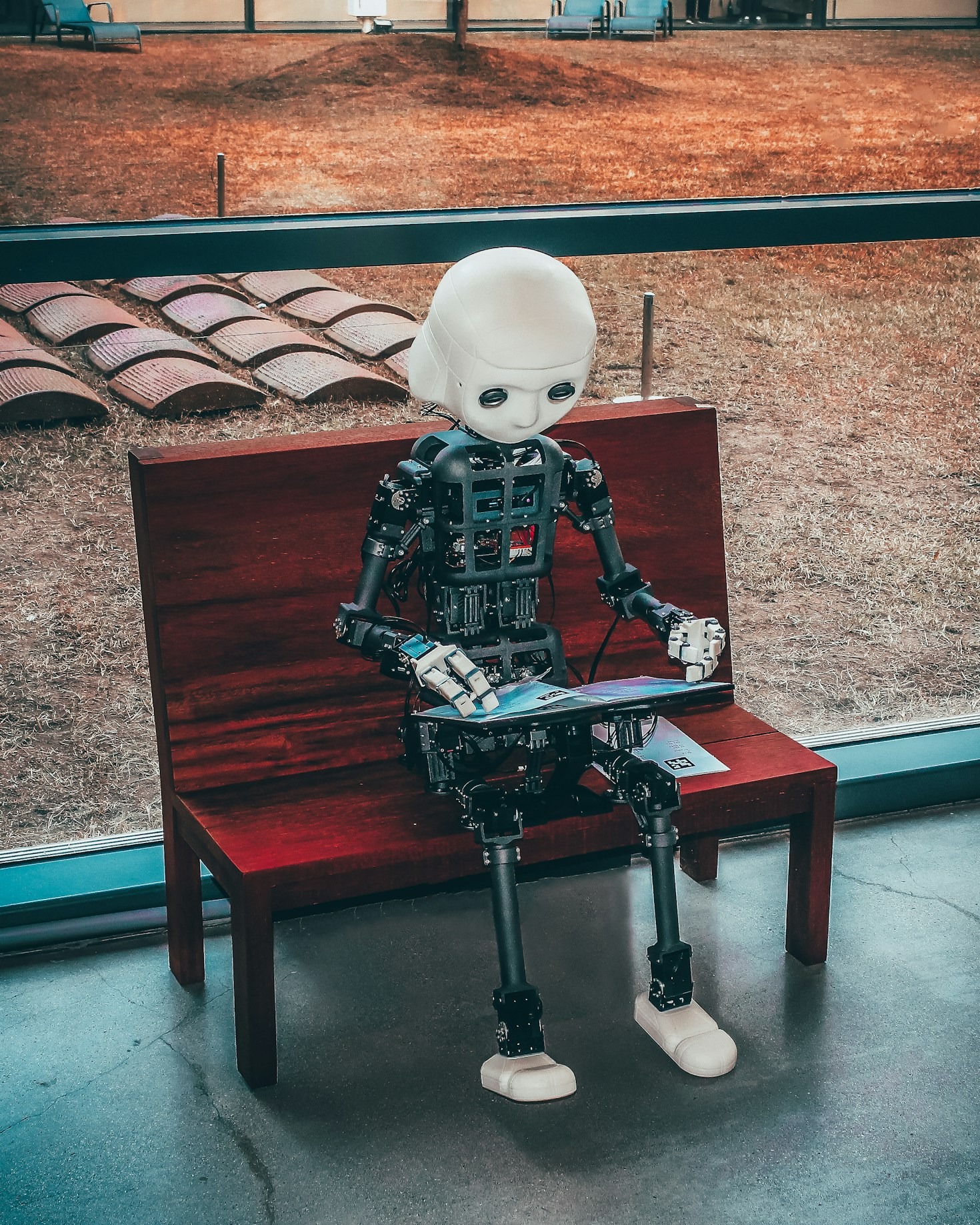

Innovating Robotics Designs

Autonomous Rover Build

Mastering Precision Machining

Custom CNC Creations

Capturing Life Through Lenses

Portrait Photography Series

Inventions That Inspire

Smart Home Automation

Revolutionizing Robotics

AI-Driven Robot Arm

Precision Engineering Projects

Advanced CNC Frameworks

Capturing Innovation Through the Art of Photography

Explore Sean Doherty’s passions and unique projects briefly.

Robotics Vision

Discover cutting-edge robot designs and engineering solutions.

Machining Mastery

Precision craftsmanship in metalworking and creative designs.

Inventive Solutions

Innovative ideas brought to life through invention and creativity.

Photographic Perspective

A visual journey showcasing the world through Sean’s lens.

Family Focus

Balancing professional pursuits with the joys of fatherhood.

Blog

Explore Sean Doherty’s latest articles, ideas, and resources designed to spark curiosity and share knowledge.

-

Workshops and Ideas: Sean’s Creative Space

This paragraph serves as an introduction to your blog post. Begin by…

-

Behind the Scenes of a Robot Builder

This paragraph serves as an introduction to your blog post. Begin by…

-

Photography as a Visionary’s Tool

This paragraph serves as an introduction to your blog post. Begin by…

Inventing the Future: Sean’s Robotics Journey

Get in Touch: Connect with Sean Easily